- Category: Article, Knowledge hub

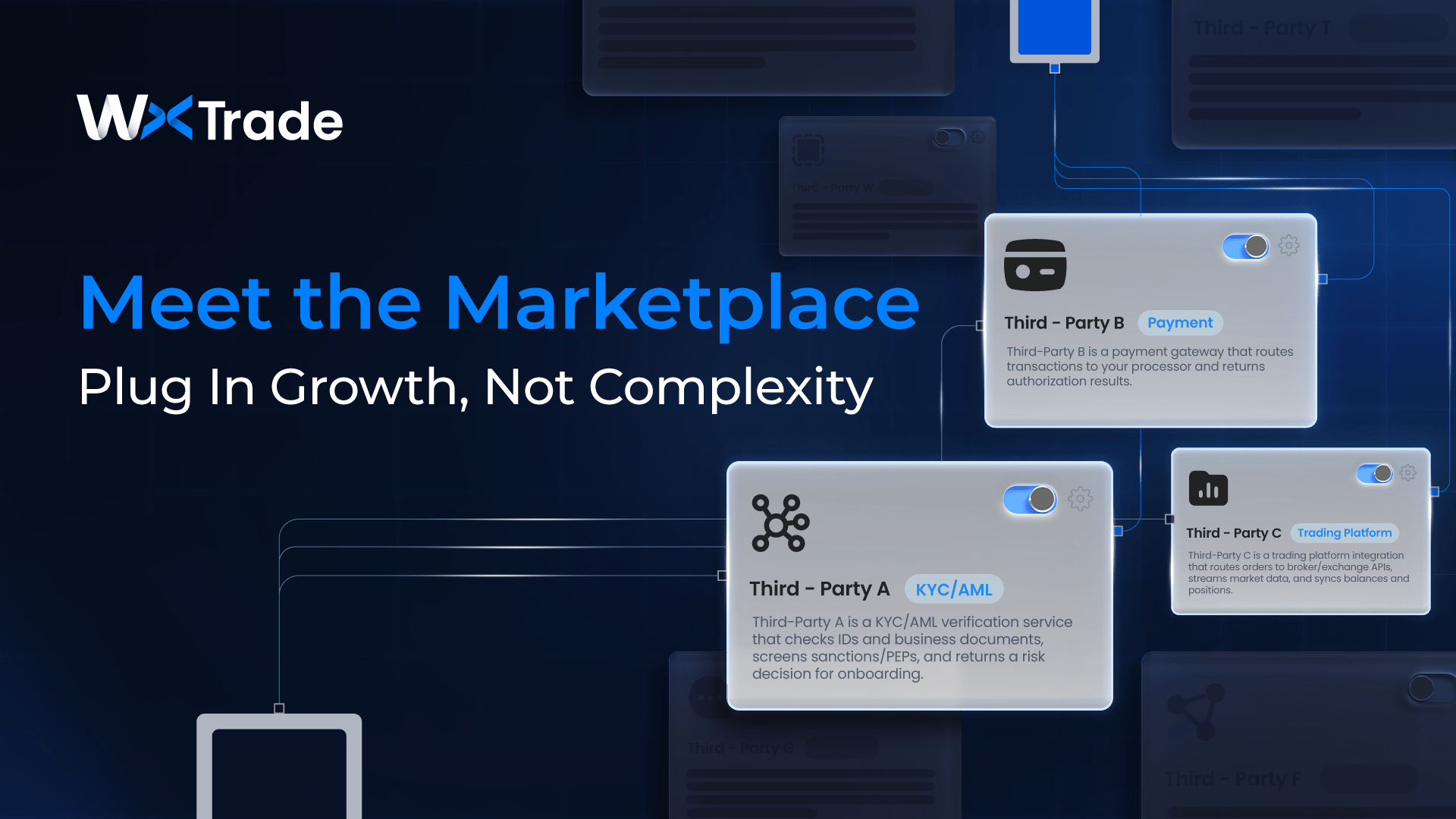

Brokerage Integration: Plug in Growth, Not Complexity

A brokerage integration marketplace is a centralized environment where brokerages can access and activate pre-built, certified integrations without having to start a new technical project each time. Instead of developing separate connections for every PSP, KYC provider, or analytics tool, parsing different API documents, and hoping each custom setup performs reliably under real client activity, a brokerage can simply select integrations that already work natively with the CRM and core systems.

At its core, a marketplace provides a central hub—typically the CRM or back office, such as Wconnex—where client data, accounts, and operational rules are maintained. Around this hub sits a catalog of compatible partners, including PSPs, KYC vendors, trading platforms, reporting and risk tools, and marketing systems. All of these connect through a standardized framework that governs authentication, configuration, interaction, and ongoing monitoring.

This structure gives brokerages both flexibility and control. They can adjust their partner stack as strategy evolves, while keeping integration methods uniform, security strong, and system oversight consistent.

From Custom Builds to Plug-In Apps

Traditionally, every new integration feels like a small project of its own. Teams need to request and analyze API documentation from each provider, developers must create custom code and data mappings, and QA and operations spend time testing behavior, edge cases, and performance. Once the connection is finally live, it adds another layer of ongoing maintenance.

The risks associated with this approach are well known. Any change in an API—on either side—can trigger downtime. Error handling tends to be inconsistent, leading to reconciliation gaps, and expanding to new regions, products, or front ends often creates additional development work.

A marketplace model replaces this cycle with a far more efficient process. The marketplace provider handles the heavy technical lift once, ensuring each integration is pre-tested, hardened, and proven across multiple brokers. Internal teams then focus mainly on configuration—such as currencies, limits, or routing rules—rather than deep engineering work.

This shift moves the organization from a “build” mindset to a “plug-in” approach, reducing integration debt and accelerating delivery across the business.

The Hub-and-Spoke Blueprint

A typical client journey begins when a new user registers through the Client Portal. Wconnex then triggers a selected KYC provider from the marketplace to run the necessary checks. Once the client is approved, they are shown the funding methods configured by the brokerage, all powered by integrated PSPs. When a deposit is made, the PSP processes the transaction and Wconnex updates the single wallet and any associated trading accounts. From there, trades flow through connected platforms and liquidity providers, while risk and reporting tools receive real-time data from the central hub. Balances, performance metrics, and partner reports are continuously updated across the CRM and client portals.

The key point is that every system connects to the hub—not directly to each other.

This design:

Reduces the total number of integrations required

Lowers the overall number of potential failure points

Makes it far easier to add, test, or replace providers without reworking the entire architecture

Core Integration Categories in a Brokerage Marketplace

A well-designed brokerage marketplace typically centers on several essential integration categories that support launch, day-to-day operations, and long-term growth.

Payments – PSPs and Gateways

Payment integrations are the engine behind deposits and withdrawals. Within a marketplace framework, a brokerage can easily offer a mix of cards, e-wallets, bank transfers, and local payment methods, tailoring the available options to each region to boost conversion. As markets shift and client profiles evolve, new PSPs can be added or swapped with minimal effort.

Because all payment connections run through a centralized integration layer, funding becomes faster and more consistent, routing rules can intelligently direct transactions based on region, currency, or risk factors, and operational disruptions from PSP API changes are significantly reduced.

KYC / AML & RegTech

KYC and AML remain essential responsibilities for any brokerage, but they don’t need to rely on manual processes. With marketplace-based integrations, brokerages can connect identity verification, document scanning, and liveness detection tools, apply sanctions and PEP screening, and feed transaction data directly into monitoring and compliance systems.

Standardized data flows and unified status handling ensure that compliance stays consistent across the organization, even when different providers are used in different regions.

Trading Platforms & Liquidity

A brokerage integration marketplace typically includes connectors for multiple trading platforms, front ends, liquidity aggregators, and pricing providers. The central objective is to keep a single client wallet and a unified operational view within Wconnex, even when several platforms are running in parallel.

When a platform or liquidity source needs to be added, removed, or replaced, the core client experience and back-office processes remain unchanged. The brokerage simply updates its marketplace configuration rather than

CRM, Client Portal, and Marketing / IB Tools

The CRM and Client Portal operate as the brokerage’s core “OS,” handling client relationships, operations, and daily activity. A marketplace expands these capabilities by connecting IB and affiliate portals, marketing automation platforms, and communication tools such as chat, email, and ticketing systems. Because everything plugs into the same central hub, acquisition, retention, and support teams all work from a unified, consistent view of each client—improving coordination and reducing operational friction.

Risk, Reporting, and Compliance Tools

Effective risk management and compliance depend on accurate data and reliable records. Marketplace integrations in this category typically include real-time exposure and P&L dashboards, trade surveillance and pattern-detection solutions, as well as regulatory reporting and archival systems. By routing these tools through Wconnex and the marketplace framework, each system receives standardized, consistent data, which streamlines reconciliation, simplifies reporting, and strengthens oversight.

Value-Add & Growth Integrations

Beyond the core operational components, many marketplaces also include growth-focused modules such as copy trading or social trading features, education and research content, and loyalty or rewards engines. These additions allow a brokerage to enhance its offering and increase client lifetime value, all without modifying the underlying technology stack. By plugging these tools into the existing hub, brokerages can innovate and expand quickly while keeping operations stable and consistent.

How Marketplace Certification Works

For a brokerage marketplace to deliver real value, its integrations must be dependable—and that reliability comes from a formal certification process managed by the marketplace provider (such as WxTrade). Before a partner is added to the catalog, it undergoes a structured review that verifies both technical quality and operational readiness.

Certification typically evaluates:

Technical and performance behavior

Security and data handling practices

Operational maturity and support capability

By selecting a certified integration, a brokerage adopts a connection that has already been tested, validated, and refined across previous implementations.

Technical & Performance Certification

On the technical side, the certification process usually covers:

Compliance with agreed API contracts and response formats

Proper handling of errors, timeouts, and retries

Stable performance under normal and peak load

Version compatibility and clear upgrade paths

Availability of health checks, logging, and monitoring signals

Once an integration is approved, improvements made at the marketplace level automatically benefit every brokerage using it. This makes onboarding more predictable and significantly more repeatable.

Compliance, Security, and Operational Readiness

Certification also addresses non-technical factors, including:

Licensing or authorization requirements for the provider

Security measures and data protection policies

Uptime commitments, SLAs, and redundancy mechanisms

Support capacity, response expectations, and incident procedures

This process doesn’t replace a brokerage’s own due-diligence obligations, but it establishes a strong baseline and eliminates redundant checks with each new integration.

Security & Compliance Basics When Partners Plug In

Even with a marketplace in place, the broker ultimately retains regulatory responsibility. A well-designed marketplace simply makes it easier to uphold those obligations. At a foundational level, this includes strong encryption for sensitive data (both in transit and at rest), robust identity and access management across systems, comprehensive audit trails for user and system activity, and data-handling practices that align with regulations such as GDPR—especially around retention and minimization.

API Security and Access Control

Sound API security should be consistent across all integrations. This typically involves using dedicated API keys or tokens for each partner and environment, enforcing least-privilege access so each provider receives only the information it truly needs, and applying IP allowlisting or controlled network access for sensitive operations. Good practices also include rate limiting, anomaly detection, and centralized logging and monitoring of critical API activity.

Regulatory & Data Protection Considerations

Regulatory requirements vary by region, but several themes appear everywhere: reliable and repeatable KYC and AML workflows, transparent and well-documented management of client data and consents, the ability to respond to data requests (export, deletion, correction), and long-term storage of trading and communication records.

Marketplace-certified integrations inside a forex CRM environment are expected to support these obligations. For example:

KYC providers maintain document storage and access under defined controls

PSPs comply with payment regulations while offering the data needed for internal monitoring

Reporting tools deliver formats and timelines aligned with regulatory expectations

The marketplace model doesn’t remove a broker’s regulatory duties, but it makes control, traceability, and proof of compliance much easier to demonstrate.

FAQ

What is a brokerage integration marketplace in simple terms?

A brokerage integration marketplace is an “app store” for brokerages. It offers pre-built, certified integrations—PSPs, KYC/AML, platforms, risk tools, and more—that connect into the CRM and core infrastructure.

Is a marketplace useful only for large brokers?

No. Pre-launch and smaller brokers benefit by avoiding complex custom builds early on. They can start with a focused setup and expand integrations as the business grows.

How does a brokerage marketplace support compliance?

Certified integrations are checked for technical robustness, security, and basic compliance readiness. Standard logging and data flows through the CRM make it simpler to prove governance and controls to regulators.