- Category: Article, Knowledge hub

Broker CRM Migration: Move Data Without Losing Anything

Migrating a brokerage CRM is not a “software switch.” It’s a risk event: you’re moving client PII (personally identifiable information), trading records, KYC (Know Your Customer) documents, AML (Anti-Money Laundering) evidence, balances, and IB (Introducing Broker) structures that directly impact payouts and partner trust. One broken relationship in this chain can create operational disruption and financial liability.

This playbook is designed for brokerage owners, operations managers, and CTOs who want a migration that is not only successful—but provably correct (you can demonstrate that nothing material was lost or corrupted).

This guide outlines common best practices for broker CRM migrations. It is not a prescriptive, step-by-step implementation manual. Your migration approach should be tailored to your brokerage’s data model, integrations, regulatory obligations, and operational constraints.

What “successful” looks like

Before migrating anything, define success in measurable terms. “It looks fine” is often how silent data loss reaches production.

A solid definition of success typically includes:

Completeness: Record counts align for every critical dataset (clients, accounts, trades, KYC documents, IB nodes).

Integrity: No broken relationships—such as accounts without clients, trades without accounts, or IBs missing parent links.

Accuracy: Key totals reconcile (balances, aggregated P&L, commission ledgers) within agreed tolerances.

Auditability: KYC/AML evidence and approval metadata are preserved; any gaps are documented and formally signed off by Compliance/MLRO (Money Laundering Reporting Officer).

Cutover control: A documented runbook governs cutover, with clear checkpoints and predefined rollback triggers.

Step 0: Assign ownership with a migration charter

Brokerage migrations are more likely to fail due to unclear ownership than technical limitations. To reduce this risk, establish a concise migration charter that formally defines decision rights, responsibilities, and approval requirements.

Begin by documenting the scope, clearly distinguishing what will be migrated into the production environment versus what will be archived. A common model is to migrate the most recent one to two years of active data while retaining older history in an archive for reference and audit needs. Next, specify downtime tolerance. If trading and operational activity cannot be paused, the migration plan must include a parallel run or advanced synchronization to maintain continuity and prevent service disruption.

The charter should also include a defined RACI for key sign-offs: the CTO remains accountable for overall delivery, the Operations Director validates business continuity controls, Finance verifies balances and commission calculations, Compliance/MLRO confirms KYC/AML evidence and regulatory readiness, and the IB/Sales Manager approves hierarchy structures and rule logic. Finally, appoint a single go/no-go authority—typically the CTO—with explicit power to halt the migration if readiness criteria are not satisfied.

Step 1: Inventory every system that feeds your CRM

A brokerage CRM rarely contains the full operational picture. In most environments, it sits at the center of multiple upstream data sources and downstream consumers, and a migration must account for both directions of integration. The first priority is to build a complete system inventory that identifies every dependency connected to the CRM.

This inventory should capture the trading and back-office feeds that supply trades, positions, and account status; the KYC and onboarding provider that generates verification events and screening outcomes; payment providers responsible for deposits, withdrawals, chargebacks, and related status updates; communications platforms that may require regulated retention for email, SMS, voice, or chat; the client portal identity layer that governs authentication and permissions; and any BI or reporting tools that query CRM data for dashboards, reconciliation, and performance reporting.

This step is critical because brokerage ecosystems are tightly interconnected. CRM records are typically linked to trading accounts, executed trades, commission calculations, and IB wallet logic. If even one integration link is missed or incorrectly mapped during the migration, the impact can cascade into inaccurate reporting, failed reconciliations, and payout errors.

Step 2: Brokerage Migration Checklist

1) Client and account master data

The client vs account distinction is fundamental: a single client may have multiple trading accounts (different currencies, different venues). If you collapse this incorrectly, you will create duplicate client profiles and lose the “single customer view” needed for risk and service.

This Include:

- Legal identity data (name, DOB, nationality, tax residence)

- Risk profile (retail/professional categorization, leverage limits, appropriateness results)

- Consents and legal timestamps (terms acceptance, disclosures). Losing timestamp proof can weaken your position in disputes.

2) Trading history and open positions

Trading history is high volume and precision-sensitive. Your biggest failure modes are:

- timestamp/timezone loss,

- rounding/decimal precision drift,

- status mismatches vs the trading system of record.

Practical strategy:

- Migrate a recent active window (e.g., last 1–2 years) into the live CRM for performance, and archive older history in a warehouse accessible via API.

- Treat open positions as high-risk. The standard method is a controlled freeze/snapshot; more advanced approaches synchronize exposure without closing/reopening positions (requires deeper integration).

3) KYC/AML artifacts (evidence + audit trail)

Migrating “Verified” status alone is not acceptable—you need the evidence and metadata that justify the decision (who approved, when, and what changed).

Your KYC migration must preserve:

- document blobs (ID scans, proofs, source of funds)

- linkage to the correct client record

- approval metadata and notes

- screening results, dates, and “next screening due” fields where applicable

And you need a compliance rule:

- Any KYC evidence gaps must be documented and signed off by Compliance/MLRO before legacy deletion.

4) IB structures, commission rules, and payout history

The IB tree is your revenue engine, and it’s structurally fragile: you must preserve the hierarchy graph, avoid breaks/loops, and ensure rules calculate the same way.

Common IB migration risks include:

- broken parent-child relationships (orphaned sub-IBs)

- loss of nuanced rules (tiering by period, hybrid deals)

- missing historical attribution dates (creates commission disputes later)

- commission ledger/payout mismatch (trust breaker)

Best practice:

- document all commission and clawback logic before migration, then test rules with real historical data.

5) Communications and case notes (where required)

If you’re in a jurisdiction requiring communications retention, preserve what exists with metadata and link it to clients (and sometimes trades).

Step 3: Choose the right migration approach

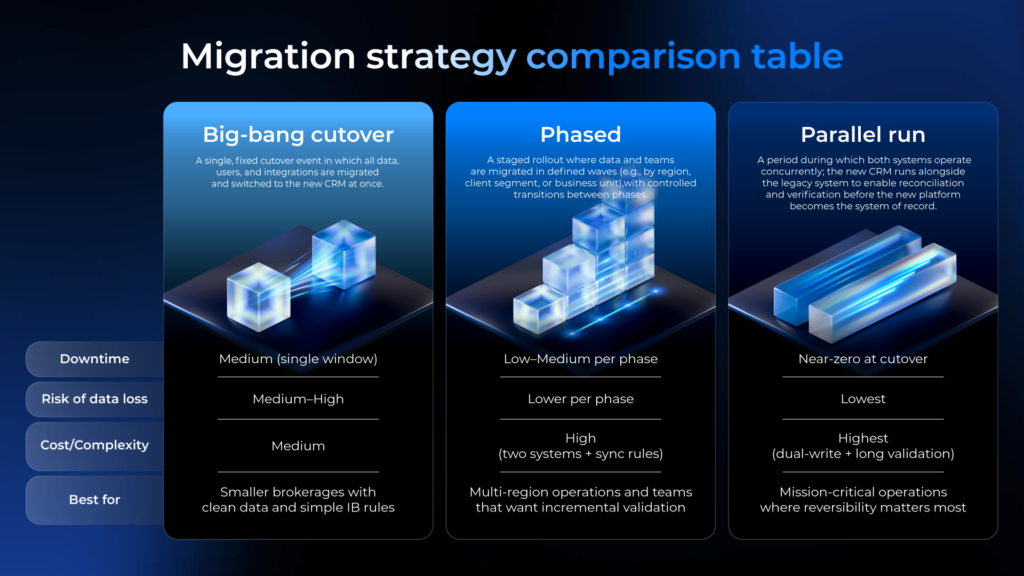

The infographic below summarizes the three CRM migration approaches—Big-bang, Phased, and Parallel run—and when each is typically used.

Step 4: Build a Data Mapping Matrix

A data mapping matrix is the primary governance tool for CRM migration. It documents how each field in the legacy environment will be translated into the new CRM, including transformation rules, validation checks, and accountable owners. This prevents “interpretation during import,” which is a common source of downstream defects.

A complete mapping matrix should include: Source Field → Target Field → Transformation/Business Rule → Validation Method → Business Owner

Brokerage-specific transformations to plan for

Client and account records

Data standardization: Normalize phone formats (E.164), structure address components, and standardize country/state codes to reduce duplicates and reporting inconsistencies.

Entity model preservation: Maintain the correct client-to-account hierarchy (one client, multiple accounts). This protects account-level trading history, balances, and permissions from being incorrectly merged or split.

Regulatory evidence continuity: Preserve consent and legal acceptance timestamps (terms, disclosures, marketing consent) to ensure audit defensibility.

Trading history

Time and sequencing integrity: Convert timestamps to UTC and retain the original timezone as reference metadata. Then validate record alignment against the trading/back-office system of record.

Financial accuracy controls: Preserve decimal precision for price, volume, swap, commission, and P&L fields. Document rounding rules explicitly to prevent drift in financial reporting and partner payouts.

Unique identifier strategy: Ensure trade identifiers remain unique. Where legacy trade IDs can collide across platforms or books, implement a compound key approach (e.g., platform + account ID + trade ID).

KYC document migration

Evidence + context transfer: Move documents into a controlled document repository with required metadata (document type, upload date, verification date, verifier, expiry, status history).

Linkage assurance: Maintain non-breaking references between each document and the correct client/account record so KYC status is verifiable, not merely displayed.

IB structures and commission rules

Commercial rule translation: Document every IB rule set (CPA, revenue share, rebates, tiering, exceptions, clawbacks) before migration, then translate into structured configuration rather than free-text notes.

Attribution history retention: Preserve historical referral attribution (who referred whom, and when). This is essential for accurate commission calculation, dispute resolution, and partner trust.

Post-migration output validation: Recalculate commissions on historical periods and compare outputs to the legacy system to confirm parity before go-live.

Step 5: Test migrations before you migrate

Avoid a single “big-bang” cutover. At minimum, complete one full test migration in a staging environment and require stakeholders to validate results field-by-field before any production move is approved.

A practical testing ladder begins with a pilot migration using a representative subset of data. This subset should include standard client profiles as well as edge cases, such as clients with multiple accounts, clients with historical KYC amendments, IB structures with tiered or hybrid commission rules, and accounts with complex trading histories. After the pilot, perform a dress rehearsal that mirrors production conditions as closely as possible. Execute the full runbook end-to-end—extract, transform, import, and validate—then measure the time and outcome of each step. Repeat and refine until the process is reliable and consistently repeatable.

Finally, conduct formal User Acceptance Testing (UAT). Operations, Support, Finance, and Compliance should validate real workflows rather than isolated records, including the KYC approval path, client lookup and servicing processes, and IB commission reporting outputs. This confirms the migration is not only technically accurate, but operationally sound.

Step 6: Validation & reconciliation framework

A brokerage migration requires a structured validation and reconciliation framework that proves the data is complete, internally consistent, and financially correct. A practical approach is to validate in layers, moving from broad completeness checks to detailed financial reconciliation, with clearly documented pass/fail criteria.

Layer A focuses on completeness through row-count comparisons. Record counts should be compared by entity type—clients, accounts, trades, KYC documents, and IB nodes—to quickly identify missing imports or partial loads. These checks are simple, fast, and highly effective at catching gaps early in the process.

Layer B validates integrity by testing relationships and enforcing “zero-orphan” expectations. Referential checks should confirm that every account maps to a valid client, every trade maps to a valid account, and all documents link back to legitimate client records. The same principle applies to IB structures, where sub-IB entities must have valid parent relationships and hierarchy rules must remain intact after migration.

Layer C addresses accuracy using checksums and controlled sampling. Hashing and checksum methods help detect silent corruption that row counts and relationship checks may not reveal. In parallel, conduct targeted “golden record” spot checks on preselected clients and accounts. A common baseline snapshot method is to store pre-cutover counts, key totals, and a client-ID hash, then rerun the same checks immediately after import to confirm equivalence.

Layer D completes the framework with financial reconciliation of balances, P&L, and commissions. At minimum, reconcile aggregate totals such as balances, equity, and commission totals between source and target. For trading history, confirm that total P&L matches within an agreed tolerance and that trade status counts reconcile against the trading platform. Where appropriate, apply variance thresholds and require documented justification and formal sign-off for any exceptions.

At the end of this process, you should be able to report clear outcomes such as an exact match for client counts, an exact match for trade counts even at multi-million scale, an exact match for KYC document counts (or a documented variance with Compliance approval), and an exact match for IB node counts.

Step 7: Cutover runbook

A controlled cutover should be treated as a scripted operational event, not an informal coordination meeting. The purpose of the cutover runbook is to make execution predictable by defining every action, dependency, validation checkpoint, and decision gate in advance, with clear owners and timing.

This guidance is directional and should be adapted to your brokerage’s architecture, integrations, and regulatory requirements.

Step 8: Hypercare and safe legacy decommissioning

Your migration is not complete at go-live. Stabilization must be planned as a formal phase, with defined monitoring, ownership, and exit criteria, because most operational risk appears after users and integrations move to the new system.

During hypercare, apply disciplined operating practices: provide 24/7 coverage in the initial period and taper only after metrics demonstrate stability; run daily standups to review incidents, risks, and open actions; and track a consistent set of health indicators, including uptime, API response times, login success rates, reconciliation variance, and support ticket volume. These measures ensure issues are detected early, triaged quickly, and resolved with traceability.

Legacy decommissioning should also be staged rather than immediate. Keep the legacy platform in read-only mode as a safety net, export the remaining historical data into a structured archive, and proceed to secure deletion only after regulatory retention obligations are satisfied and all required sign-offs are completed.

Conclusion

A broker CRM migration is only “successful” when you can prove nothing critical was lost—client records, trading history, KYC/AML evidence, balances, and IB structures all need to carry over with the same relationships and audit trail intact. The safest migrations follow a consistent pattern: define measurable success criteria, inventory every connected system, lock your must-not-lose dataset, map and transform deliberately, test with a pilot and rehearsal, validate with counts and reconciliations, then cut over with a documented runbook and rollback triggers.