- Category: Article, Knowledge hub

Prime of Prime Liquidity: A Beginner’s Guide for Brokers

Prime of prime (PoP) liquidity is one of those phrases that appears in almost every brokerage pitch deck and vendor proposal, but many launch-stage teams only have a rough idea of what it actually involves.

At its core, prime of prime liquidity is how newer and mid-sized brokers plug into deep institutional FX and CFD markets without needing the balance sheet, credit lines, or direct bank relationships that large institutions rely on. Instead of negotiating with multiple tier-1 banks and venues, you work with a specialist intermediary that aggregates those relationships and exposes them to you in a usable, broker-friendly way.

In this guide, we’ll walk through what prime of prime liquidity is, where it sits in your brokerage stack, who it suits at different stages, how connectivity works (bridges, routing, infrastructure), which KPIs truly matter, how pricing is structured, and the most common pitfalls to avoid when you select and integrate a PoP provider.

This content is for information purposes only and does not constitute financial advice.

Prime of Prime Liquidity

The institutional FX and CFD market works like a private club. Direct access is usually limited to large banks, funds, and a handful of top-tier brokers with substantial capital and strong credit profiles. A prime broker is generally a large bank that sponsors those clients into the club, extending its own balance sheet and relationships so they can trade.

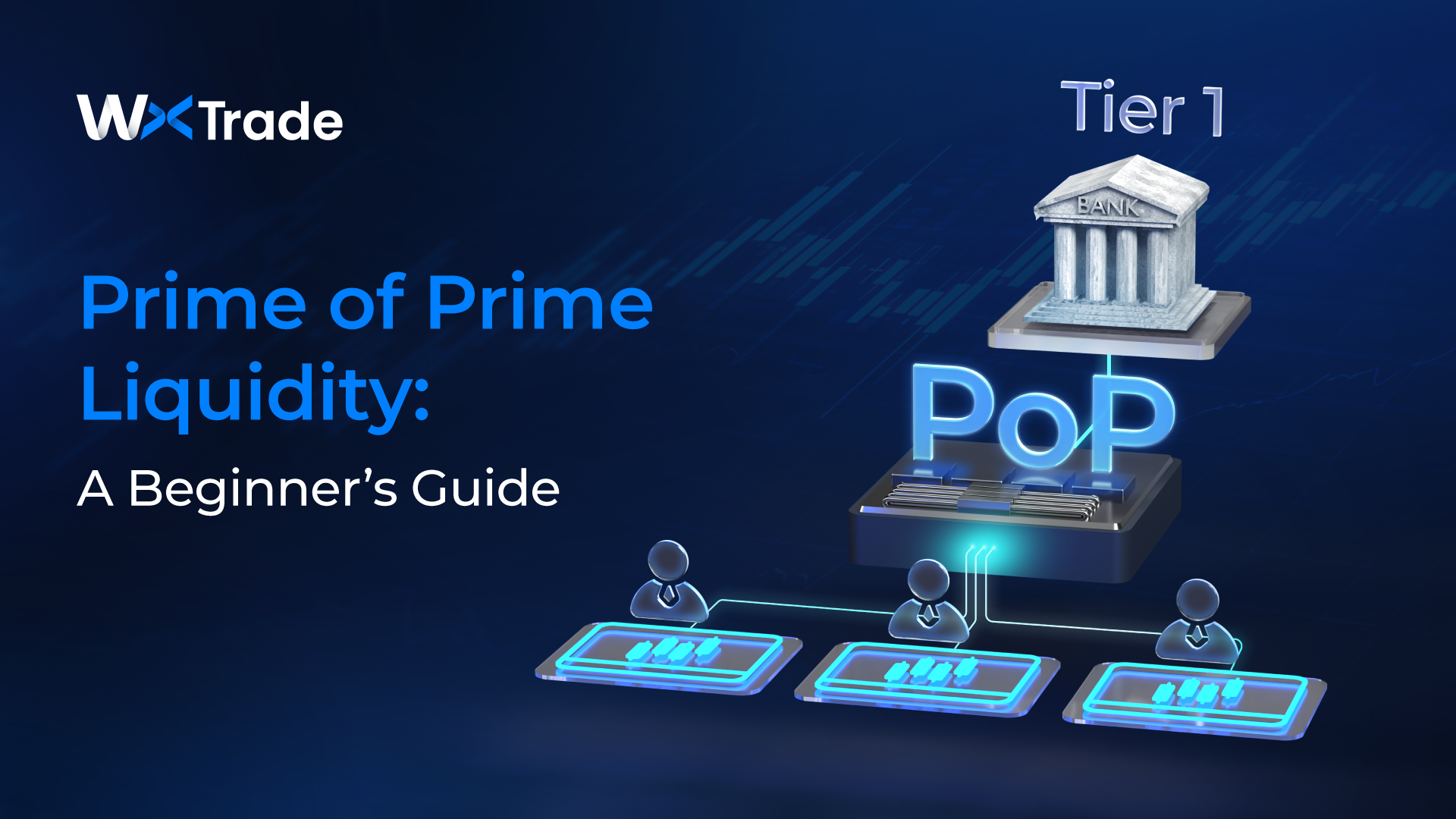

Most retail and mid-tier brokers cannot satisfy those capital and credit requirements. A prime of prime broker sits one step down the chain. It holds direct relationships with tier-1 banks, ECNs, and non-bank market makers, and then repackages that access for smaller brokers. In effect, the PoP becomes your “mini-prime broker”: it provides institutional pricing and execution, manages credit risk, and offers technology tuned for high-volume, smaller-ticket retail or professional flow.

Functionally, your flow looks like this:

Trader → Your brokerage → Prime of Prime → Tier-1 banks and venues

The prime of prime is therefore both a credit intermediary and a liquidity aggregator. It is much more than a single liquidity provider streaming prices from one venue.

Liquidity basics: spreads, depth, and slippage

To understand whether a PoP setup is genuinely good, it helps to break liquidity down into three concepts.

First, spread is the difference between bid and ask. Tight spreads are attractive for marketing and client acquisition, but the spread is meaningful only if it is reliably tradeable. Second, depth of market describes how much volume is available at each price level. A market can appear tight at the top of book but be very thin as soon as clients trade in larger size. Third, slippage is the difference between the price your client clicks and the price they actually receive. Slippage can be negative, when the client receives worse pricing, or positive, when they receive a better fill.

A strong prime of prime relationship combines reasonable, sustainable spreads with consistent depth and a slippage profile that shows both positive and negative outcomes, not just one-way negative slippage.

Where Prime of Prime Sits in Your Brokerage Stack

From your clients’ point of view, they simply press “buy” or “sell” and see a confirmation a moment later. Underneath that experience is a chain of systems, each of which can affect execution quality.

A typical order journey might look like this. A trader sends an order from a mobile, web, or desktop platform. Your trading server receives the order, applies risk and routing logic, and decides whether to internalize the risk or externalize it. For orders that are A-Booked, the server passes the order to a liquidity bridge or gateway, which in turn connects to your prime of prime via FIX or a proprietary API. The PoP validates the order against price, risk, and credit parameters and then routes it to the most suitable venue in its liquidity pool. Once the venue executes the order, a fill report is sent back through the PoP, through your bridge and trading server, and finally to the client terminal.

At every step—risk engine, bridge, PoP gateway, and external venue—latency, configuration, or capacity constraints can show up as rejections, poor slippage, or inconsistent fills.

A-Book, B-Book, and hybrid models

Your dealing model determines how you use the prime of prime link.

In a pure A-Book model, most client risk is externalized. Orders are hedged one-for-one (or close to it) with your PoP. The PoP becomes a central part of your revenue and risk framework, because your spreads, commissions, and hedging costs are tightly connected to its pricing and fee structure.

In a B-Book model, you internalize risk and act as market maker to your clients. Even here, a prime of prime connection is still important because you will typically externalize certain positions, hedge net exposure in aggregate, or route particular client segments out to the market.

In reality, many brokers follow a hybrid model. Some flow is internalized, some is fully A-Booked, and some is dynamically routed based on behavior, profitability, or regulatory considerations. A good PoP connection gives you flexibility to shift between these modes without rebuilding your entire liquidity stack.

Talk to us about unified PoP connectivity.

Is Prime of Prime Right for Your Brokerage Stage?

PoP liquidity is no longer reserved only for well-established firms. It is increasingly a realistic option for start-up brokers and scaling operations.

For a new brokerage, a prime of prime relationship can be the difference between launching with thin, retail-only feeds and entering the market with credible, bank-grade pricing. With a PoP, you do not need to negotiate directly with multiple banks. You can start with one institutional-grade access point and build your product and marketing around that.

During onboarding, expect the PoP to review your license and regulatory status, your operating jurisdictions, your target client base and business model, your estimated volumes and average ticket sizes, and your platform and risk-management setup. They assess not only commercial potential but also whether your flow profile aligns with their liquidity sources.

For a scaling or multi-asset broker, prime of prime liquidity offers a route to expand into additional asset classes and venues without rebuilding your infrastructure. You might start with major FX pairs and then add metals, indices, energies, or selected digital assets through the same PoP relationship. As volumes grow, it becomes common to introduce multiple PoPs, using aggregation and smart routing to optimize pricing while also reducing dependency on any single venue.

At still larger scale, you may explore a direct prime broker relationship with a tier-1 bank. That step often supplements rather than completely replaces existing PoP arrangements; the PoP may remain your preferred route for certain products, regions, or client segments.

Connecting to PoP: Bridges, Aggregation, and Routing

A strong prime of prime setup can still produce disappointing results if the connectivity layer is fragile or poorly configured. Bridges, aggregators, routing rules, and hosting all matter as much as the headline liquidity itself.

Liquidity bridges and APIs: the gateway layer

The liquidity bridge is the major connector between your trading servers and the PoP. It is responsible for mapping your symbols to the PoP’s symbol universe, transforming order formats into FIX or another supported protocol, applying markups and commission rules, enforcing routing decisions, and reconciling execution reports.

From an implementation perspective, the PoP typically provides a suite of APIs and FIX sessions that your bridge or core trading engine can connect to. Before going live, you will run through conformance tests and a period of user acceptance testing to confirm symbol mapping, pricing behavior, order handling, and reporting are all consistent with your expectations.

Aggregation and smart order routing

When you connect to more than one prime of prime or to additional bank and non-bank liquidity providers, you generally introduce an aggregator. The aggregator receives multiple price streams and builds a consolidated book. It then decides where to send each order, based on routing rules that take into account best bid/offer, available size, minimum and maximum ticket constraints, historical rejection behavior, and sometimes more advanced analytics.

This layer is particularly important for higher-value or institutional-style clients. They judge you by your ability to fill larger tickets gracefully, to maintain stable execution during volatile markets, and to avoid chronic rejections or unbalanced slippage.

Latency, hosting, and data centres

Execution quality is also heavily influenced by where your systems physically live. Many FX and CFD venues operate matching engines in large financial data centres in London, New York, or Tokyo. If your trading servers, bridge, and prime of prime infrastructure are hosted in or near the same facilities, latency can be kept low and predictable.

Lower latency typically means that quotes are fresher when they reach your clients, that there is a smaller window for prices to move between click and fill, and that your orders have less chance of being rejected for being off-market. When evaluating PoP and bridge solutions, it is therefore useful to ask where their servers are located, what typical round-trip times look like, and whether cross-connects or private links are available rather than relying solely on the public internet.

How Prime of Prime Liquidity Is Priced

Prime of prime pricing is usually built from a mix of spreads, commissions, and a handful of less visible fees.

One common model is spread-based pricing, in which the PoP streams you a raw or semi-raw spread from its venues. You then add your own markup. The client effectively pays via the spread and may not see a separate commission. Another model emphasizes commission per million traded. In that scenario, you may pass through almost raw spreads and charge a defined dollar amount per million units of notional traded. This approach can make it easier to keep spreads sharp while tuning commission levels for different client segments.

Beyond spreads and commissions, most PoPs also define minimum monthly fees. These MMFs ensure they earn a baseline amount even when your volumes are small. There can also be market-data charges, redistribution fees for certain venues, minimum ticket fees or surcharges for very small trades, and connectivity or hosting charges if you use dedicated lines or co-location.

The combination of all these elements determines your all-in cost per million of traded notional. It is useful to build a simple model that calculates effective cost under realistic volume assumptions.

For example, imagine one PoP offers low commissions but a high MMF, while another charges a higher commission per million but a much lower MMF. At relatively low volumes, the high MMF provider may end up significantly more expensive on a per-million basis. As volumes grow, the fixed MMF cost is spread over more notional, and the provider with higher variable commissions may end up being the more expensive one. Running scenarios at several volume levels helps you compare proposals fairly.

Common PoP Pitfalls and How to Avoid Them

Not every offering labeled “prime of prime” is created equal. Several recurring issues appear across the market, especially for newer brokers.

A first pitfall is the quasi-PoP that simply resells another PoP’s feed. In this scenario your orders travel through additional hops, each adding latency and cost. You may be exposed to stacked markups and less transparent counterparty risk. Asking whether the provider maintains direct prime-broker relationships, which venues it connects to, and whether it can provide transaction cost analysis is a good starting point.

A second risk is single-venue reliance. When all of your external risk runs through one prime of prime or one major venue, an outage or sudden change in risk appetite can immediately hit your clients. Purposeful redundancy—by using more than one PoP or mix of PoP and other LPs, and configuring failover behavior in your bridge or core engine—helps reduce this dependency.

A third area to watch is last look misalignment. Even when you are comfortable with the concept of last look, you may find over time that your clients experience high rejection rates, especially during fast markets, or that slippage appears systematically one-sided. Aligning PoP settings with your best-execution policy, reviewing TCA reports, and monitoring complaints and support tickets can surface these issues early.

Finally, both brokers and PoPs pay close attention to flow quality. Certain behaviors—rapid-fire trading around news, latency arbitrage, and strategies that rely on stale quotes—can be seen as toxic by liquidity providers. Ignoring this topic entirely can strain relationships and lead to worse pricing or tighter limits. A more sustainable approach is to monitor behavior, understand how your order flow appears from the PoP’s perspective, and use risk tools, routing criteria, and reasonable constraints to keep the relationship balanced.

Conclusion and Next Steps

Prime of prime liquidity gives new and scaling brokers a practical route into institutional markets. It turns what would otherwise be a complex web of bank relationships, credit discussions, and connectivity projects into a manageable set of commercial and technical decisions.

The key questions are straightforward. Where does the PoP sit in your overall architecture? How solid is the connectivity layer that links your trading servers to their systems? Which KPIs show that execution quality is genuinely strong, not just cosmetically attractive? And how transparent is the provider about pricing, last look, venues, and incident handling?

Used thoughtfully, prime of prime liquidity becomes a lever for better execution, better risk management, and a more scalable brokerage business—not just another vendor line item.

FAQ

What capital do I need to work with a prime of prime broker?

Capital requirements vary by provider, but they are generally much lower than those for a direct prime broker relationship with a tier-1 bank. You will still need an appropriate license, a clear business model, and enough capital and collateral to satisfy risk and credit policies.

Can I use more than one prime of prime at the same time?

Yes. Many brokers deliberately connect to more than one PoP to improve redundancy and pricing. Doing so usually requires either an aggregation layer or carefully configured routing logic, but it can materially improve resilience and bargaining power.

How does prime of prime liquidity affect my A-Book/B-Book strategy?

A prime of prime link is primarily a channel for externalizing risk and implementing A-Book or hybrid models. It allows you to hedge specific clients, strategies, or exposure profiles while internalizing others. The quality of this link has a direct impact on the economics and risk of your A-Booked business.