- Category: Event, FinTech, Uncategorized, WxTrade

Fintech & Banks: Who Leads APAC’s Future?

Fintech firms scale fast, build lean, and speak the language of digital-native customers. Incumbent banks, meanwhile, still anchor the system with deposit trust, regulatory rigor, and balance-sheet scale. In Hong Kong and across APAC, the question isn’t “who wins” so much as “how quickly each camp can absorb the other’s strengths without losing its edge.” This piece takes a neutral look at what’s really changing—and what to watch next.

What’s changing: velocity × trust

Fintechs are built for velocity: short release cycles, rapid experimentation, and quick response to user feedback. That speed shows up in higher deploy frequency and shorter recovery times when something breaks. Banks, by contrast, trade speed for trust—capital buffers, rigorous controls, tested continuity playbooks, and well-defined recovery objectives.

The frontier in APAC is convergence. Banks are borrowing software disciplines (API-first, CI/CD, modular architectures), while fintechs are adopting more formal risk disciplines (structured incident management, third-party risk reviews, independent testing). The players that integrate both muscles—velocity and trust—will set the pace.

APAC reality check: regulation and expectations

Hong Kong and Singapore offer a clear view of the direction of travel. Supervisors emphasize operational resilience, outsourcing oversight, and transparent incident handling. At the same time, customers expect seamless digital onboarding, strong authentication, and near-continuous availability. The practical takeaway: growth must be paired with verifiable controls—change management, disaster recovery drills, and measurable SLAs—regardless of whether you’re a fintech or a bank.

Can fintechs replace cores—or complement them?

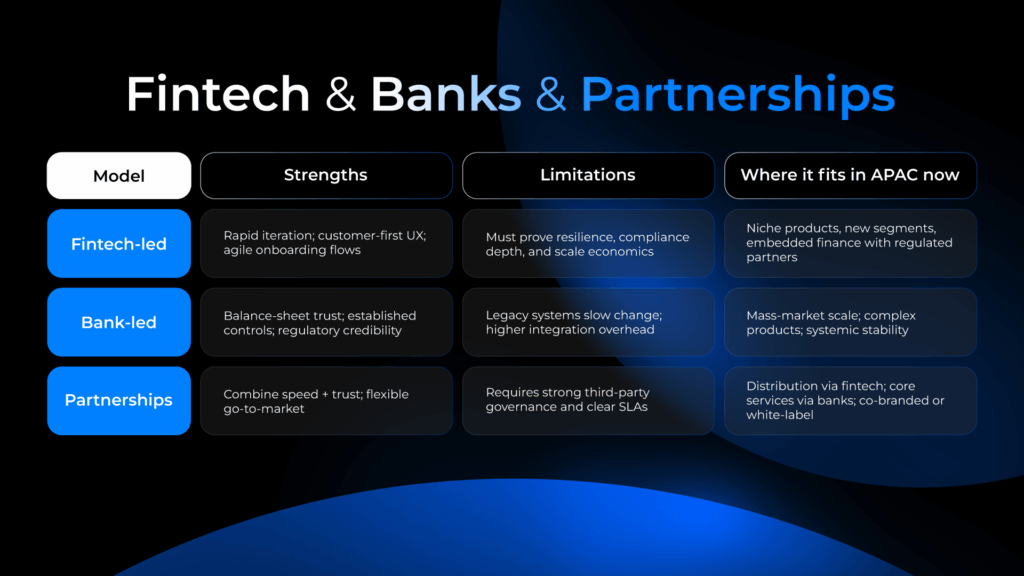

Despite headlines, wholesale replacement is rare. Fintechs shine in product UX, personalization, and speed of iteration. Banks excel at scale: prudential oversight, balance-sheet strength, and mature compliance operations. In practice, embedded-finance and partnership models keep expanding—distribution by fintech, regulated rails by banks—because each side offsets the other’s blind spots. Durable wins come from clarity on roles (who holds risk?), shared telemetry (who sees what, when?), and exit plans (what if a partner fails?).

Are incumbents adapting fast enough?

Many banks started with digital “wrappers”—polished apps on top of legacy cores. That approach has diminishing returns. The conversation has moved toward API gateways, orchestration layers, and modernization of core components that bottleneck change. The danger is “innovation theater”: demos without measurable impact on onboarding time, reliability, or unit economics. A better signal is when change management, resilience testing, and third-party oversight mature alongside customer-facing features.

Final thought

Whether fintechs “replace” banks is the wrong frame. The story is about combinatorial advantage: pairing software velocity with institutional trust. The firms that operationalize both—measured in reliability, compliant speed-to-market, and transparent partner governance—will set the standard for the region’s next chapter.

See it live at iFX EXPO Asia

If you want to dig deeper into the ideas in this article, join our speaker Leo Vance for “Built to Last or Bound to Break: Can Traditional Banks Survive the Fintech Era” on 28 October, 14:40–15:20 (Speaker Hall). The show runs 27–28 October 2025 at AsiaWorld-Expo, Hong Kong.

What to expect on the floor. iFX EXPO Asia brings together the region’s trading, fintech, payments, liquidity and technology ecosystem with 4,000+ attendees, 150+ exhibitors, and 100+ speakers across multiple stages—designed for senior decision-makers who want substance over hype.

Who you’ll meet. The attendee mix spans brokers and prop firms, fintech and trading tech providers, liquidity and market-data specialists, payment solutions, IBs and affiliates, plus compliance and regulatory experts—a dense network for partnerships and product discovery in one venue.

Agenda & networking highlights. Expect two content tracks (including Speaker Hall and Idea Hub), 27+ sessions and 13+ hours of content, with the official Welcome Party on 26 October to kick off meetings before the expo opens. The iFX EXPO app helps you preview the schedule and book meetings in advance so you can make every hour count.