- Category: Article, Knowledge hub

The Hidden Costs of Starting a Brokerage

The “Cheap Launch” illusion

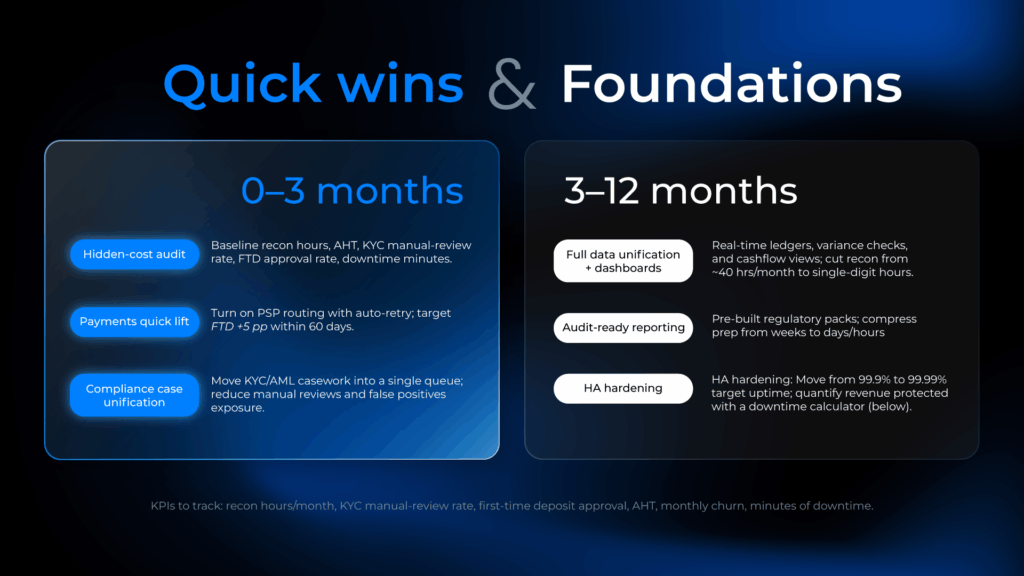

Most first-time founders plan for visible setup items—company formation, license, a trading stack, a basic CRM—and assume the rest will “sort itself out.” In practice, the big bill arrives after launch: manual reconciliation hours, compliance firefighting, payment declines, swivel-chair work across systems, and scaling surprises. That’s your TCO iceberg: a small capex tip above water and a massive operational base below.

Across the industry, teams routinely spend 20–40 hours/month on manual recon alone, while onboarding friction and payment failures waste acquisition spend—classic “leaks” that don’t show up in the vendor price list.

This guide breaks down the real cost drivers—and shows how a unified stack cuts waste, accelerates growth, and protects margins.

Five hidden costs draining brokerage profitability

1) Platform fragmentation.

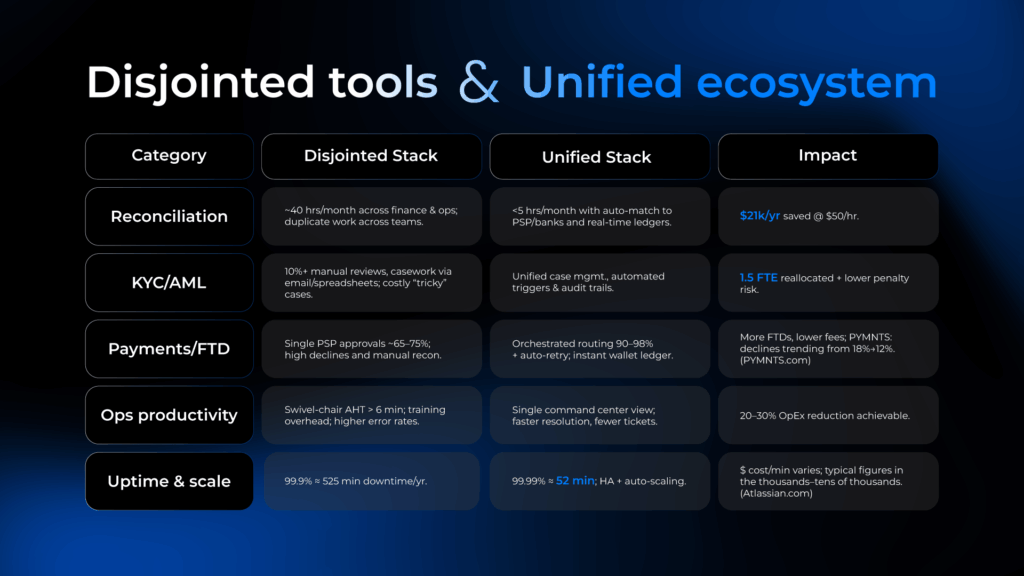

When your platform, CRM, KYC, payments, and reporting live in silos, every workflow turns into a stitching exercise. Data drift shows up as inconsistent balances, reconciliation gaps, and ticket escalations—while you pay “middleware tax” and carry vendor lock-in risk that slows innovation and drives fees up over time.

Why it matters: A fragmented stack multiplies duplicate licenses, recon hours, and latency hops—and it compounds over time. A unified data layer and real-time sync eliminate the “glue work” people currently do between systems.

2) Compliance overheads (KYC/AML, reporting, audit prep)

Manual KYC reviews, AML false positives, and month-end reporting crush bandwidth. Some firms report $1,500–$3,000 to clear a single “tricky” KYC case once you add staff time and third-party fees—worse in fragmented environments where analysts hunt across systems.

Regulators have intensified scrutiny: CySEC conducted 850+ on-site and remote audits in 2024, reminding firms that shaky data lineage and slow responses carry real consequences. (cysec.gov.cy) Fragmented reporting means days of reconciling platform A + platform B + CRM just to file routine reports—work that often drags senior management into firefights.

Fix the architecture, cut the load: A unified compliance layer centralizes KYC/AML, case management, automated audit trails, and one-click regulatory reports, shifting effort from manual collation to exception handling.

3) Churn from friction & inconsistent UX

Onboarding and first-time deposit (FTD) are make-or-break. Disjointed flows force multiple logins, duplicate data entry, and clunky PSP handoffs—users abandon. Orchestrated payments consistently beat single-PSP setups on approvals (~65–75% vs 90–98%), directly lifting FTD conversion and revenue.

The payments landscape is improving: card declines fell from 18% to 12% between 2022 and 2024 thanks to tokenization and stronger auth—brokers that can route intelligently capture those gains; others leave money on the table. (PYMNTS.com) UX inconsistency (balances, bonuses, history) and slow support drive avoidable churn in fragmented ops.

4) Operational inefficiency (“swivel-chair” operation)

When staff switch between CRM, trading back office, payment portals, spreadsheets, and ticketing to answer a simple question, average handle time spikes and error rates climb. Benchmarks show finance teams losing up to a quarter of their week to manual processes—real salary dollars spent on low-value work.

Simple math: if 10 operation/compliance/support staff cost $50k/month all-in and fragmentation makes them 20% less efficient, you’re leaking $10k/month (>$120k/yr) to process waste—before counting opportunity cost.

5) Scaling delays, downtime & tech debt

Uptime isn’t a brag line; it’s a P&L line. Moving from 99.9% to 99.99% uptime shrinks annual downtime from ~525 minutes to ~52 minutes, protecting trading revenue and avoiding compensation/reputational fallout. Industry research often cites per-minute outage costs in the thousands to tens of thousands; even conservative math adds up fast. (atlassian.com)

And tech debt? Slow shipping and brittle integrations translate directly into opportunity cost—missed listings, delayed features, emergency firefights, and, in bad cases, settlements after outages.

ROI snapshot: calculators you can run today

1) Downtime economics

Revenue Protected== Annual Revenue/ 525,600 ×Minutes Saved

Example (conservative): $18M annual revenue ⇒ $34.25/min; moving from 99.9% to 99.99% saves ~473 minutes ⇒ ~$16.2k protected revenue (not counting reputational or compensation costs).

2) Reconciliation labor savings

Net Annual Savings=(Daily Hours Saved×Loaded Hourly Rate×252)−Tooling

Example: 1.8 hours/day saved at $50/hr ⇒ $22,680/yr.

3) Onboarding conversion uplift

Monthly Revenue Gained=(New Leads×ΔConversion)×LTV

Lift FTD approvals with orchestration; declines are falling industry-wide (tokenization/3DS). Capture the upside instead of funding abandons. (PYMNTS.com)

Implementation checklist

- Instrument your baseline: recon hours, manual-review rate, FTD approval, AHT, churn, downtime minutes.

- Unify identity & ledger: one client record across CRM, trading, and payments; eliminate duplicate schemas.

- Turn on payment orchestration & auto-reconciliation (route + retry + cost-aware + instant matching).

- Centralize compliance: one queue for KYC/AML + automated audit trails and report packs.

- Harden uptime: HA targets to 99.99%; monitor minutes down as a board-level KPI.

Track ROI monthly: plug deltas into the calculators above and your P&L model.

FAQ

What are the hidden costs of starting a brokerage?

Five buckets: fragmentation, compliance, churn, operational inefficiency, and scaling/downtime/tech debt—all rooted in architectural choices made at day zero.

How much can a unified platform really save?

Brokers report 20–30% OpEx reduction via automation, fewer errors, higher approvals, and better retention—savings that scale with volume.

Why do KYC and payments crush conversion?

Clunky KYC flows and single-PSP setups force drop-offs and declines; orchestration + unified UX closes the gap (e.g., 65–75% → 90–98% approvals).